In our fast-paced and aggressive small business natural environment, firms are continually looking for ways to improve the look of his or her personal businesses, enhance money pass, and reduce management overhead. One answer gaining interest can be factoring, a financial service enabling businesses best invoice factoring software to convert his or her receivables into immediate cash. To take care of and improve your factoring process proficiently, many businesses are generally making use of factoring software. This information explores factoring application, it’s advantages, functions, and the actual way it can improve small business operations.

What is Factoring?

Factoring can be a personal understanding where by an organization offers it’s financial records receivable (invoices) to be able to a third party, referred to as a aspect, with a discount. In exchange, this business draws immediate money, it are able to use for business demands like having to pay workforce, getting catalog, and also increasing operations. If the buyer pays your sales receipt, your aspect requires your cost, minus his or her fee.

Factoring aids businesses with terrible and also inconsistent money pass avoid waiting around 30 to be able to ninety days for buyer payments. As a substitute, they might admittance immediate performing capital, which will help manage clean businesses and growth.

What is Factoring Software?

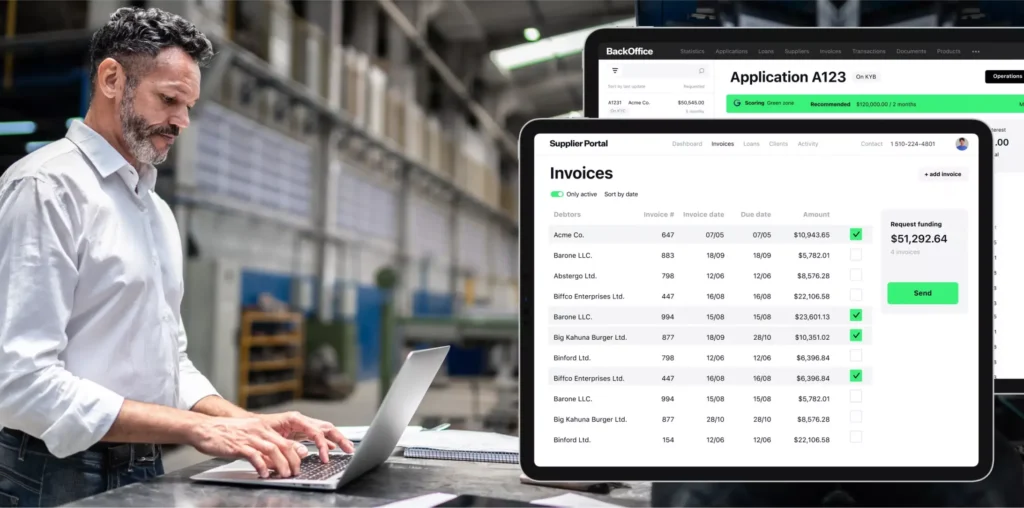

Factoring application is your specialised software built to improve and enhance the full factoring process. The idea streamlines duties just like sales receipt managing, cost following, probability review, and consumer communication. Factoring application typically features a selection of functions that really help factoring firms and businesses cope with the investment and collection of receivables effectively.

Your primary goal connected with factoring application is to get rid of manual functions, reduce potential risk of human miscalculation, and give real-time presence in to the position connected with transactions. By automating factoring, businesses can concentrate on expansion instead of finding bogged straight down by way of time-consuming management tasks.

Features of Factoring Software

- Invoice Administration: Factoring application makes easier the entire process of presenting and following invoices. It provides an arranged method where by businesses can easily publish, keep, and admittance invoices. The software likewise allows people to trace your position of each one invoice—no matter if it is settled, can be unresolved, or perhaps is overdue—making sure superior presence of money flow.

- Real-Time Reporting and Analytics: Having factoring application, people can generate precise studies and analytics to keep track of your functionality with their factoring operations. The software trails crucial measurements like fantastic balances, ageing studies, consumer cost tendencies, and factoring charges, empowering businesses to make informed decisions.

- Programmed Warns and Memory joggers: Factoring application can send programmed reminders to be able to consumers concerning owing payments. This decreases the manual hard work were required to comply with fantastic bills and enhances money pass management. Additionally, it enhances buyer human relationships by supplying regular and consistent communication.

- Possibility Analysis and Credit history Reviewing: Numerous factoring application options contain built-in consumer credit rating functions that appraise the creditworthiness connected with customers. This aspect allows factoring firms to assess probability previous to getting receivables, making sure many people help consumers that have a high chances of having to pay his or her charges about time.

- Invoice Backing and Disbursement: Factoring application aids improve the entire process of money invoices. After the sales receipt is eligible, the unit can estimate your money volume and disburse money to be able to this business quickly. Several application options even deliver the option of prompt and also same-day money, which will is especially valuable for businesses that need immediate liquidity.

- File Administration: The software permits your storage space and managing of most suitable documents relevant to factoring transactions. This includes deals, bills, consumer letters, and cost records. Having papers managing functions, businesses can admittance many important papers from your middle foundation and minimize documents clutter.

- Customer and Client Site: Numerous factoring application options give a webpages for the factoring company along with clients. This webpages enables consumers to evaluate your position with their bills, make bills, and speak with your factoring company. This self-service alternative minimizes the need for typical calling and also messages, saving your time for both parties.

- Stability and Consent: Factoring application guarantees details safety with the use of security, protected end user admittance settings, and frequent backups. It assists to businesses conform to polices relevant to details safeguards and personal reporting, just like the Common Information Safety Legislation (GDPR) and anti-money laundering (AML) requirements.

Benefits of Factoring Software

- Improved Funds Movement: Factoring application allows businesses to acquire more quickly use of performing capital by way of simplifying and automating your factoring process. Having speedier processing situations and productive following connected with receivables, businesses can improve their money pass, which happens to be crucial for retaining daily operations.

- A serious amounts of Cost Cost savings: By automating duties like sales receipt following, cost reminders, and reporting, factoring application minimizes the need for manual intervention. This can lead to time period and expense cost savings, allowing workforce to focus on much more strategic duties instead of management chores.

- Much better Possibility Administration: Having built-in consumer credit probability assessments and consumer credit rating, factoring application aids businesses minimize potential risk of utilizing difficult to rely on customers. This will help to avoid high priced defaults and poor financial obligations that may normally break up money flow.

- Improved Customer Relationships: Factoring application can enhance communication concerning businesses and their potential customers by supplying consistent, programmed messages about sales receipt status. Customers reap the benefits of regular reminders and practical cost solutions, that may grow their expertise and strengthen this business relationship.

- Streamlined Procedures: Your centralization connected with factoring businesses into one particular foundation tends to make it easier for businesses to deal with various consumers, bills, and dealings from once. The software streamlines the full factoring process, from money to be able to cost following, making sure simpler operations.

- Much better Decision-Making: Your real-time details and analytics proposed by factoring application deliver businesses with valuable observations to their factoring performance. These kinds of observations can often make better personal conclusions, discover tendencies, and enhance small business operations.

How Factoring Software Helps Different Types of Businesses

- Compact Organizations: Small establishments with reduced money pass can significantly reap the benefits of factoring application mainly because it permits them to admittance performing capital quickly. By freelancing your management weight to be able to factoring application, they might concentrate on expansion without the need of having to worry with regards to unpaid invoices.

- Factoring Firms: Factoring application is especially used by factoring firms that cope with huge volumes connected with invoices. The software assists them determine consumer creditworthiness, cope with various consumers, and improve the full factoring process, generating businesses more effective and scalable.

- Shipping and Logistics Firms: Shipping factoring is normal while in the travel market, where by transportation firms normally depend on factoring to improve money flow. Factoring application adapted to your freight market can cope with trucker bills, help quick bills, and give precise reporting for superior decision-making.

- Program Companies: Service-based businesses that difficulty bills because of their expert services, just like marketing and advertising firms, companies, and also IT organizations, may reap the benefits of factoring software. The idea permits them to swiftly aspect bills, creating more capital to invest in ongoing initiatives and develop operations.

Conclusion

Factoring application is an essential software for businesses looking to improve the look of his or her factoring functions and improve their money flow. By automating duties like sales receipt managing, cost following, and consumer sales and marketing communications, factoring application will save you time period, minimizes human miscalculation, and enhances total efficiency. The rewards aren’t just on a small businesses but will also lengthen to be able to factoring firms, companies, and strategic planning businesses.

The opportunity to cope with receivables, determine consumer credit probability, and acquire real-time observations into personal functionality tends to make factoring application a critical advantage for firms hoping to grow their personal operations. If your business is hoping to enhance it’s liquidity and also improve the look of businesses, factoring application affords the equipment desired to achieve a competitive marketplace.