Influencers and content creators have transformed the digital world by sharing valuable content, engaging audiences, and building personal brands. Whether you’re a YouTuber, Instagram influencer, TikTok creator, or blogger, earning from brand deals, ad revenue, and sponsorships can become complex. Unlike traditional jobs with fixed salaries, content creators often receive payments from multiple sources, making it challenging to track earnings. A free payroll check maker can help simplify financial management, ensuring accurate payment tracking and organized financial records.

Why Payment Tracking Matters for Influencers

Unlike employees who receive regular paychecks from a single employer, influencers and content creators deal with multiple income streams, including:

- Brand sponsorships

- Affiliate marketing

- Ad revenue (YouTube, TikTok, blogs)

- Product sales

- Crowdfunding (Patreon, Buy Me a Coffee)

- Freelance content creation

Without a proper system, tracking these payments can lead to miscalculations, missed invoices, and tax issues. A free payroll check maker offers a solution by creating detailed paychecks that record earnings, taxes, and other deductions.

Benefits of Using a Free Payroll Check Maker

1. Organized Payment Records

Content creators often receive irregular payments. A payroll check maker helps organize all payments by generating structured pay stubs, making it easier to track income over time.

2. Simplifies Tax Filing

Taxes can be a headache for influencers, especially those classified as independent contractors. Using a payroll check maker allows creators to document their earnings properly, making tax season smoother.

3. Professional Invoicing for Clients

Brands and sponsors prefer professional invoices and paychecks rather than informal payment requests. A payroll check maker generates official payment records, increasing credibility.

4. Tracks Multiple Income Streams

Since content creators earn from different platforms, a payroll check maker consolidates all payments in one place, ensuring no earnings go unnoticed.

5. Helps with Budgeting and Financial Planning

Knowing exactly how much you earn helps in budgeting, saving, and planning for business expenses like equipment, ads, or hiring assistants.

Step-by-Step Guide to Using a Free Payroll Check Maker

Step 1: Choose a Reliable Payroll Check Maker

Look for a free payroll check maker that is user-friendly and offers professional templates.

Step 2: Enter Personal and Business Details

Fill in your name, business name (if applicable), and contact information. This step ensures professional-looking paychecks.

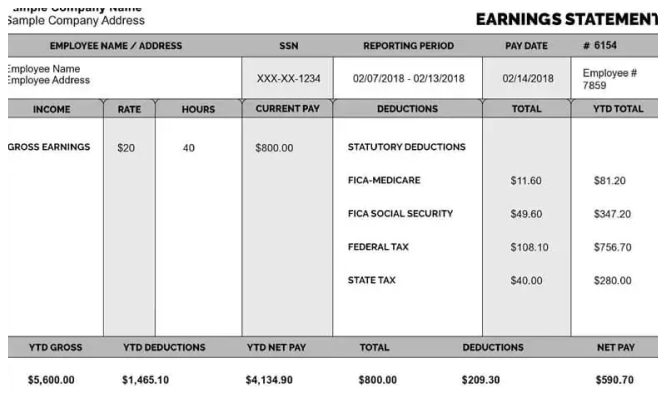

Step 3: Input Payment Details

- Enter the payment amount.

- Include payment dates to track past and pending earnings.

- Add income sources (e.g., YouTube AdSense, Instagram sponsorships, TikTok Creator Fund).

Step 4: Include Deductions and Taxes

If you set aside a portion for taxes, note the deductions. Freelancers often need to handle self-employment taxes, so keeping records is essential.

Step 5: Generate and Save Paycheck Records

Once all details are entered, generate the paycheck and save a copy. Store these pay stubs for financial tracking and tax reporting.

Best Practices for Influencers Using Payroll Check Makers

1. Keep Track of Every Payment

Even small sponsorship deals should be recorded to ensure accurate earnings tracking.

2. Set Aside Money for Taxes

Since influencers are responsible for their own taxes, regularly saving a portion of income prevents financial stress during tax season.

3. Separate Personal and Business Finances

Using a payroll check maker helps content creators treat their brand as a business, ensuring financial separation and better management.

4. Plan for Business Expenses

Content creation requires investments in cameras, software, and marketing. Tracking earnings helps plan for these expenses effectively.

5. Stay Consistent with Record Keeping

Regularly updating your payroll records prevents confusion and ensures accurate financial reporting.

Conclusion

Tracking payments as an influencer or content creator doesn’t have to be overwhelming. A free payroll check maker simplifies financial management by organizing earnings, tracking payments, and preparing for taxes. By using this tool, creators can maintain financial stability, plan for business growth, and present a professional image to brands and sponsors. Whether you’re a full-time influencer or just starting, keeping track of your income ensures a smooth and successful content creation journey.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?