India Venture Capital Investment Market Overview

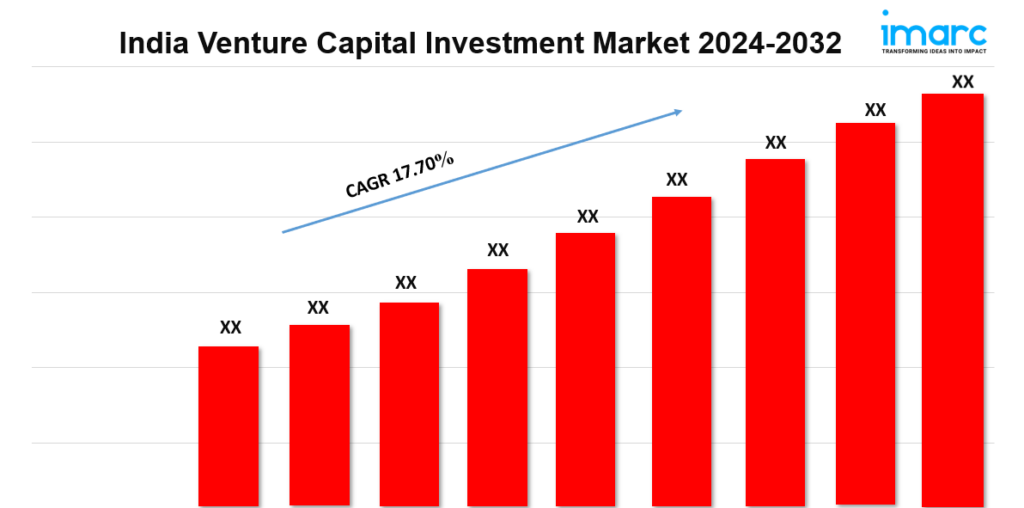

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 17.70% (2024-2032)

The India venture capital investment market is rapidly growing, driven by tech startups, innovation, digital transformation, and increasing investor interest. According to the latest report by IMARC Group, the market is projected to grow at a CAGR of 17.70% from 2024 to 2032.

India Venture Capital Investment Market Trends and Drivers:

The India venture capital investment market scene is now focused on technology startups. The pandemic has sped up digital transformation. This shift has drawn investors to sectors like fintech, edtech, healthtech, and e-commerce. Increased internet access and smartphone use have boosted demand for tech solutions.

As a result, many new startups have emerged. Venture capital firms are now looking beyond traditional tech companies. They are exploring new business models that use artificial intelligence, blockchain, and data analytics. Government programs, like Startup India, support entrepreneurship and innovation.

These initiatives offer various incentives and help. As a result, demand for venture capital in technology is expected to grow. Investors want high-growth potential and scalable models. A key trend in the Indian venture capital market is impact investing. Here, investors aim to create social and environmental benefits alongside financial returns.

This trend is growing as more investors see the value of sustainability and corporate responsibility today. Sectors like renewable energy, agritech, and healthcare are especially attractive. They tackle urgent societal issues while providing profitable investment chances. More consumers are aware of sustainability, which is driving startups to innovate.

This shift is attracting venture capital. Also, impact investing is aligning with government policies on sustainable development. This creates a favorable environment for these investments. This trend could change the venture capital landscape in India. It encourages more funds to adopt an impact-first approach in their strategies.

The Indian venture capital market is changing. New funding models are appearing for startups. Traditional equity financing now includes options like revenue-based financing, convertible notes, and venture debt. These options help startups manage capital and reduce ownership dilution. As the startup world grows, founders are more selective about funding types.

They often choose models that fit their growth paths and operational needs. This trend is drawing in different investors, like family offices, corporate venture arms, and international funds. They are all eager to tap into the Indian market. This influx is enhancing the dynamism and resilience of India’s venture capital scene. Startups can now access capital in different forms tailored to their specific needs.

The venture capital market in India is changing fast. In 2024, technology-driven solutions are at the forefront. Investors are interested in sectors using advanced technologies like artificial intelligence, machine learning, and blockchain. This shift shows a desire for future growth, not just a response to current market demands.

Increased investments in these areas also gain from government policies that support digitalization and entrepreneurship. The growth of remote work and digital services has sped up technology adoption in various industries. This change creates a strong environment for startups to succeed. Additionally, the venture capital ecosystem is becoming more inclusive.

There is a growing focus on supporting underrepresented founders and diverse teams. This trend highlights the value that diverse perspectives bring to innovation and problem-solving. As we look into 2024, the connection between technology and inclusivity will likely drive new startup success stories in India. This will make the venture capital landscape more vibrant and dynamic than ever.

Request for a sample copy of this report: https://www.imarcgroup.com/india-venture-capital-investment-market/requestsample

India Venture Capital Investment Market Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Sector:

- Software

- Pharma and Biotech

- Media and Entertainment

- Medical Devices and Equipment

- Medical Services and Systems

- IT Hardware

- IT Services and Telecommunication

- Consumer Goods and Recreation

- Energy

- Others

Breakup by Fund Size:

- Under $50 M

- $50 M to $100 M

- $100 M to $250 M

- $250 M to $500 M

- $500 M to $1 B

- Above $1 B

Breakup by Funding Type:

- First-Time Venture Funding

- Follow-on Venture Funding

Breakup by Region:

- North India

- West and Central India

- South India

- East and Northeast India

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=21123&flag=C

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145