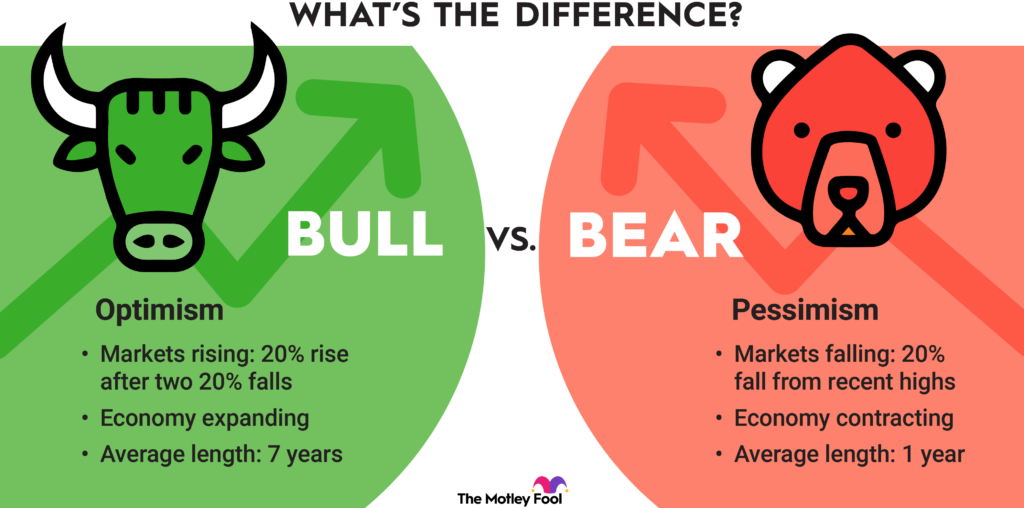

The terms bull market and bear market are common in the stock market world. Bull Market and Bear Market are actually two of the charm pieces of stock market trends, and each have various opportunities and risks for investors. By recognizing the differences between them and mastering the ways to prevail in each one, the investors can manage their money better.

In this blog, we will explain the bull vs bear market, compare their benefits and risks, and determine which is better for investors.

What is a Bull Market?

A bull market occurs when a stock is booming, is going up, and/or is expected to be going up for a long time. It is distinguished by high investor trust, industrial expansion, and the general optimistic mood in the financial industry.

Key Features of a Bull Market:

- Stock prices increase steadily.

- Investor confidence is high.

- Economic indicators such as GDP growth, low unemployment, and corporate profits show positive trends.

- Companies expand their businesses.

- Higher returns on investments.

Advantages of Investing in a Bull Market:

- Higher Returns – Investors can enjoy significant capital gains as stock prices continue to rise.

- Economic Growth – Companies perform well, leading to better job opportunities and overall economic expansion.

- Increased Investor Confidence – More people invest in the market, driving stock prices further up.

- Easier Access to Capital – Companies can raise funds easily through IPOs and secondary offerings.

Risks of Investing in a Bull Market:

- Overvaluation – Stocks may become overpriced, leading to potential market corrections.

- Market Volatility – Sudden market crashes can lead to significant losses.

- FOMO (Fear of Missing Out) – Investors might buy overpriced stocks, leading to poor long-term returns.

What is a Bear Market?

A bear market occurs when stock prices drop by 20% or more for a long period. It is characterized by pessimistic investor views, economic depression, and a lot of fear in the financial markets.

Key Features of a Bear Market:

- Stock prices decline continuously.

- Investors sell off their holdings.

- Economic indicators such as GDP decline, higher unemployment, and lower corporate earnings.

- Panic selling is common.

- Less access to capital for businesses.

Advantages of Investing in a Bear Market:

- Buying Opportunities – Quality stocks can be purchased at discounted prices.

- Higher Dividend Yields – As stock prices fall, dividend yields become more attractive.

- Defensive Stocks Perform Well – Sectors like healthcare, utilities, and consumer staples tend to hold their value.

- Better Long-Term Growth Potential – Investing in undervalued stocks during a bear market can yield high returns when the market recovers.

Risks of Investing in a Bear Market:

- Loss of Capital – Prices can continue to fall, leading to unrealized or realized losses.

- Reduced Business Growth – Companies may struggle, leading to layoffs and economic downturns.

- Low Investor Confidence – Fear and uncertainty dominate the market.

Bull vs Bear Market: Which is Better for Investors?

Both bull and bear markets offer unique opportunities and challenges. Let’s compare them based on different investment strategies:

| Factor | Bull Market | Bear Market |

| Stock Prices | Rising | Falling |

| Investor Sentiment | Positive | Negative |

| Economic Growth | Strong | Weak |

| Best Investment Strategy | Growth Investing | Value Investing |

| Risk Level | Lower | Higher |

| Profit Potential | High | High (if invested wisely) |

Which Market is Better?

The answer depends on the type of investor:

- For Long-Term Investors: Bear markets provide great buying opportunities to accumulate strong stocks at lower prices.

- For Short-Term Traders: Bull markets are better as they offer quick gains through momentum trading.

- For Dividend Investors: Bear markets allow dividend reinvestment at lower costs, leading to compounding benefits.

How to Invest Smartly in Both Markets?

Investment Strategies for a Bull Market:

- Buy Growth Stocks: Invest in companies with strong earnings potential.

- Hold Long-Term Investments: Take advantage of rising prices for higher returns.

- Diversify Portfolio: Spread investments across sectors to reduce risks.

- Use Stop-Loss Orders: Protect gains by setting automatic sell limits.

Investment Strategies for a Bear Market:

- Focus on Defensive Stocks: Invest in industries like healthcare, utilities, and consumer goods.

- Use Dollar-Cost Averaging (DCA): Invest a fixed amount regularly to reduce risk.

- Look for Value Stocks: Buy fundamentally strong companies at discounted prices.

- Consider Gold & Bonds: Safe-haven assets perform well during downturns.

Conclusion

Bull and bear markets are the types of investments that will give you rewards which are more than unique. The phase of market growth is when investors can reap profits quickly and the economy is flourishing, but in case of downturns it becomes possible to buy some stocks at lower prices which are already solid. The main tip for a successful investor is to catch the market cycles, keep a diversified portfolio, and have the right strategies for each condition.

By staying informed and making strategic investment decisions, investors can benefit from both market conditions and grow their wealth over time.

Want to stay ahead in the stock market? 📈 Download the Pocketful App today for real-time market insights and expert trading strategies!

Frequently Asked Questions (FAQs)

1. What is the key difference between a bull and bear market?

A bull market is when stock prices rise for a long period, while a bear market is when prices decline significantly.

2. How long do bull and bear markets last?

Bull markets can last for years, while bear markets are typically shorter but more intense.

3. Should I stop investing during a bear market?

No, bear markets offer great opportunities to buy strong stocks at lower prices.

4. What are the best investments in a bull market?

Growth stocks, technology stocks, and IPOs usually perform well.

5. What are the safest investments in a bear market?

Defensive stocks, gold, bonds, and dividend stocks are safer choices.