Dilution protection refers to contractual provisions that limit or outright prevent an investor’s stake in a company from being reduced in later funding rounds. The dilution protection feature kicks in if the actions of the company will decrease the investor’s tax withholding estimator percentage claim on assets of the company. For example, if Company A has $9 billion in outstanding shares and a $0.10 difference between its basic EPS and diluted EPS, that calculates to $900 million in potential new common shares and dilution.

Anti-Dilutive Securities and EPS FAQs

These are contracts that give the owner the right to purchase common stock at a given price at a given time. When stock options are exercised, the options become common shares and increase the number outstanding. Common stock is obviously the most common dilutive security because any additional issuances of common stock will automatically raise the number of outstanding shares. The corporation’s stock that has been approved and issued is known as the outstanding shares. Investors or institutions own the corporation through its outstanding shares.

To Ensure One Vote Per Person, Please Include the Following Info

It has implications when you’re calculating fully diluted earnings per share. A basic EPS equals the company’s net income minus preferred dividends, divided by the weighted- average of outstanding common shares. Despite this result, the anti-dilutive security should be included in the calculation of a fully diluted EPS. Dilution can happen in any number of ways and announcements of company actions that dilute shares are typically made during investor calls or in a new prospectus.

Is a High Diluted EPS Better Than a Low Diluted EPS?

Because dilution can reduce the value of an individual investment, retail investors should be aware of warning signs that may precede potential share dilution, such as emerging capital needs or growth opportunities. However, a high diluted EPS with a small difference between it and basic EPS is preferable. This corporate situation should obtain higher valuations from the market with investors more willing to pay a premium for each share.

How Does a Diluted EPS Affect Shareholders?

When the number of shares outstanding increases, each existing stockholder owns a smaller, or diluted, percentage of the company, making each share less valuable. A company’s diluted earnings per share (EPS) is calculated when all convertible securities are converted. Securities that can be converted into common stock are called dilutive securities.

The two common types of anti-dilution clauses are known as “full ratchet” and “weighted average.” We will talk more about each of the two types more specifically in the next sections. Sometimes the company receives enough cash in exchange for the shares that the increase in the value of the shares offsets the effects of dilution; but often this is not the case. Stock equivalents potentially dilute eps when they provide a mechanism by which net income may be distributed to shareholders in the form of dividends or share repurchases.

Anti-dilution provisions are clauses in securities contracts that protect investors from dilution. Anti-dilution provisions can impact the fully diluted EPS calculation as they can affect the conversion price of the securities. This means that, if converted, EPS would be higher than the company’s basic EPS.

- That may lead shareholders to believe their value in the company is decreasing.

- There are various types of securities that could impact the fully diluted EPS calculation.

- This means that, if converted, EPS would be higher than the company’s basic EPS.

- It is relatively simple to analyze diluted EPS as it is presented in financial statements.

- Dilution protection refers to contractual provisions that limit or outright prevent an investor’s stake in a company from being reduced in later funding rounds.

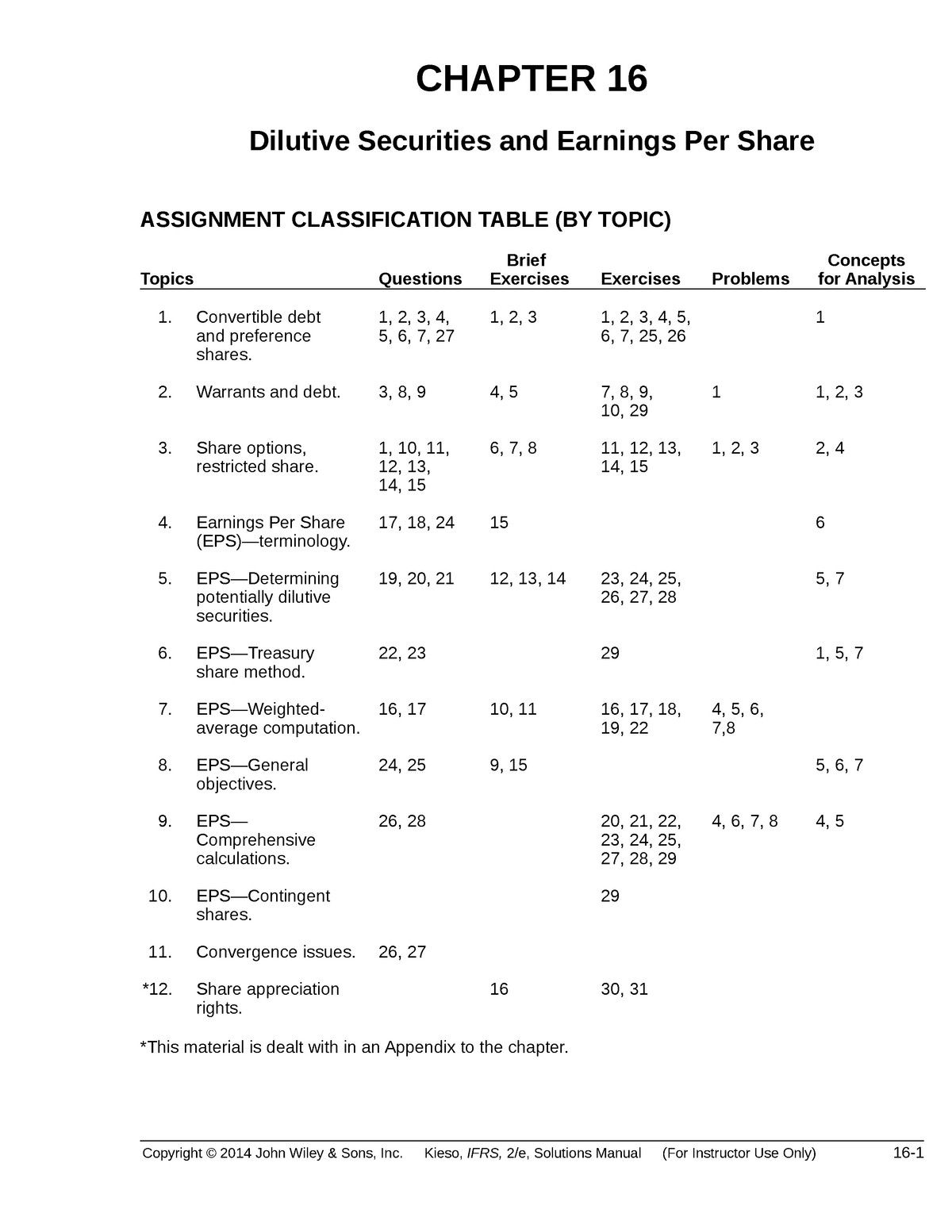

There are various types of securities that could impact the fully diluted EPS calculation. The most common types of securities include stock options, warrants, convertible preferred stocks, convertible bonds, and anti-dilution provisions. Anti-dilution provisions are clauses built into convertible preferred stocks and some options to help shield investors from their investment potentially losing value. When new stock issues hit the market at a lower price than that paid by earlier investors in the same stock, equity dilution can occur. Anti-dilution provisions are also called anti-dilution clauses, subscription rights, subscription privileges, or preemptive rights. Fully diluted shares outstanding are the total number of shares a company would theoretically have, including basic shares outstanding, if all dilutive securities were exercised and converted into shares.

Both the executive stock option plan as well as the acquisitions are expected to dilute the current pool of outstanding shares. Further, the proxy statement had a proposal for the issuance of newly authorized shares, which suggests the company expects more dilution in the near-term. Often times a public company disseminates its intention to issue new shares, thereby diluting its current pool of equity long before it actually does. For example, MGT Capital filed a proxy statement on July 8, 2016, that outlined a stock option plan for the newly appointed CEO, John McAfee. Additionally, the statement disseminated the structure of recent company acquisitions, purchased with a combination of cash and stock.

The potential for dilution of the company’s shares may concern analysts and investors. When stock options are exercised, the number of outstanding shares increases, which can impact the fully diluted EPS calculation. The denominator of the fully diluted EPS formula includes all common shares and potentially dilutive securities that could be converted into common shares.